Employee Resources and FAQ’s

- Employee Compensation

- Part-time hourly employees

- Full-time hourly employees

- Salary employees

- Unemployment Benefits

- Texas Workforce Commission Tools

- Where to apply for unemployment

- Documentation ASI can provide

- What is the definition of being laid off?

- What is the definition of being furloughed?

- Does it matter how long I have been employed with ASI?

- How is my base period for unemployment benefits calculated?

- What if TWC is not accepting my correct hourly rate?

- What if I don’t know my gross wages from ASI or from my other employer?

- Issue getting on the unemployment benefit site

- Are my weekly unemployment benefit taxable?

- Federal $600 / week pandemic relief funds

- FEMA $300 / week pandemic relief funds

- Do I need to re-apply for TWC benefits if furloughed again?

- What happens if my regular unemployment benefits are exhausted?

- Employee Benefits

- Health insurance

- 401K Options

- FMLA Options

- Am I eligible to use paid time off if I am furloughed?

- Do I still accrue vacation hours while I am furloughed?

- Educational reimbursement

- Fitness & Cell Phone Reimbursement

- Government legislation

- Where do I find official legislation documents from Congress?

- What is the “Emergency Paid Sick Leave Act”?

- What is the “Emergency Family and Medical Leave Expansion Act”?

- When does this law go into effect?

- Financial Assistance Programs by County

- Contact Human Resources

Employee Compensation

Part-Time Hourly Employees

- Effective 03/16/20: Part-time hourly employees have been laid off due to COVID-19

Full-Time Hourly Employees

- Pay Period: 07/20/20 – 08/02/20

- Employees will be compensated for hours worked and their average 6 month incentive.

- Effective 08/03/20: Full-Time hourly employees will be furloughed unless otherwise notified.

- This is a temporary furlough. Continue to check this site for information on when ASI will re-open for business.

- View Unemployment Benefits

Full-time Salary Employees

- Pay Period: 07/20/20 – 08/02/20

- Employees will be compensated for 40 hours per week.

- Effective 08/03/20: Full-Time salary employees will be furloughed unless otherwise notified.

- This is a temporary furlough. Continue to check this site for information on when ASI will re-open for business.

- View Unemployment Benefits

Unemployment Benefits

ASI encourages employees to file for unemployment in the event they’re laid off or furloughed. Please use the resources on this page to learn more about filing an unemployment claim. If you need additional support, and/or documentation, please use contact human resources form.

Texas Workforce Commission Tools

Where to apply for unemployment

- Apply for unemployment by going to the Texas Workforce Commission website, and select “Unemployment Benefits Services”.

- Apply for Benefits

Documentation ASI can provide

Please use the contact human resources form to obtain the below documentation if needed. Please use the corporate address listed below when filing your claim.

- Employer Name and Address

- Name: ASI Gymnastics

- Address: 11910 Greenville Ave, Suite #502 Dallas, TX 75087 .

- First and last day of work

- Number of hours worked the week of applying

What is the definition of being laid off?

Layoffs are due to lack of work, not your work performance, so you may be eligible for benefits. For example, the employer has no more work available, has eliminated your position, or has closed the business.

What is the definition of being furloughed?

A temporary leave of employees due to special needs of a company or employer, which may be due to economic conditions at the specific employer or in the economy as a whole.

Does it matter how long I have been employed with ASI?

Unemployment benefits are not determined by how long you have been employed at ASI Gymnastics. The Texas Workforce Commission uses the taxable wages, earned in Texas, that any employer has reported paying during your base period to calculate your benefits. Please see “How is my base period for unemployment benefits calculated?” to learn more.

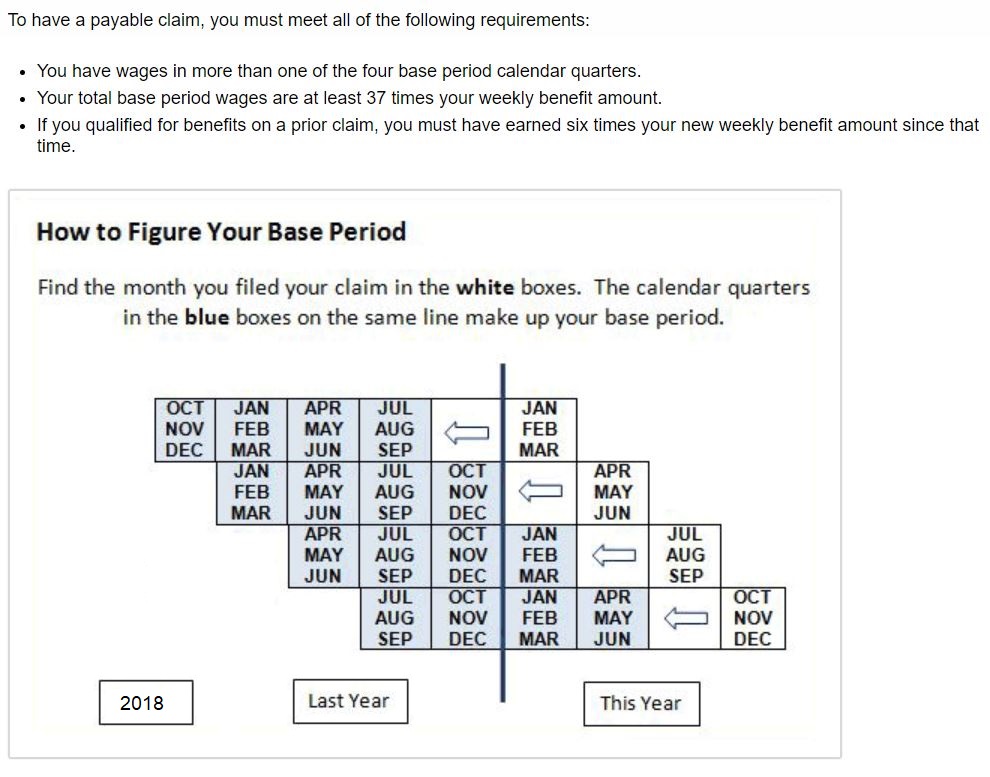

How is my base period for unemployment benefits calculated?

Your base period is the first four of the last five completed calendar quarters before the effective date of your initial claim. The Texas Workforce Commission does not use the quarter in which you file or the quarter before that. Use the chart and information below to determine your base period.

What if TWC is not accepting my correct hourly rate?

Enter a rate that allows you to proceed with your claim. After your claim is processed, contact TWC with your correct rate. TWC does not determine your unemployment benefit from your hourly rate, but from total wages earned reported by all of your employers during your base period.

What if I don’t know my gross wages from ASI or from my other employer?

You will not need to know any gross wages for any of your employers. TWC does all of that work for you and will look up your reported wages that all of your jobs have reported.

Issue getting on the unemployment benefit site.

The TWC site is experiencing a large quantity of applications. Users have reported that if you keep refreshing the page until you are on, the page will eventually load (even if you are in the middle of the process).

Are my weekly unemployment benefit taxable?

Your benefits are income you must report to the Internal Revenue Service (IRS). The TWC will withhold 10 percent of your benefits for taxes if you complete and return the Voluntary Withholding form. TWC sends you and the IRS a Form 1099-G in January with the benefits amount paid in the previous calendar year.

Federal $600 / week pandemic relief funding

The emergency increase in unemployment compensation, which includes the additional $600 / week in unemployment benefits was passed in the CARES Act on 03/27/20. The last week to claim the additional $600 is the week of 07/19 – 07/25/20.

Why is this additional $600/week ending?

TWC does not have the authority to extend the $600 a week benefit. The July 25, 2020, expiration date was set by federal law, and cannot be appealed, waived, or modified. Any change requires congressional action.

When is my last payment with the additional $600?

-

-

- If you request payment for the weeks of July 18 and July 25 – You will receive the additional $600 for both weeks.

- If you request payment for the weeks of July 25 and August 1 – You will receive the additional $600 for the week of July 25 only.

-

Why does the additional $600 (FPUC) end in Texas on 7/25 when the CARES Act lists 7/31?

July 31 is a Friday and by law TWC cannot pay partial week benefits. A full benefit week begins on Sunday and ends on Saturday. As a result, only payment requests for weeks ending on or before July 25 can include the additional $600. State unemployment benefits will continue to be paid after this date they simply won’t include the additional $600 anymore.

FEMA $300 / week Lost Wages Assistance Program

TWC notice about the FEMA $300 / Lost Wages Assistance funding ending.

The Federal Emergency Management Administration (FEMA) notified the Texas Workforce Commission (TWC) that the last week of funding for the Lost Wages Assistance (LWA) program was the benefit week ending September 5, 2020.

FEMA previously approved TWC for six weeks of funding from August 1, 2020, through September 5, 2020 for the Lost Wage Assistance $300 benefit program but has now been provided notification that no additional LWA payments will be allowed for weeks subsequent to September 5, 2020.

For what weeks did TWC receive funding?

-

-

- August 1, 2020

- August 8, 2020

- August 15, 2020

- August 22, 2020

- August 29, 2020

- September 5, 2020

-

TWC will continue to pay eligible claimants for the approved six weeks, for as long as the existing FEMA funds deposited to TWC remain available.

Will I continue to receive my state unemployment benefits?

-

-

- Yes. Claimants will continue to receive normal weekly benefit amount for any benefit weeks for which they are eligible.

-

Why is LWA funding ending?

-

-

- This decision was made by FEMA. LWA relies on funds administered by FEMA. TWC cannot provide additional funds without further federal action.

-

Can I appeal this decision?

-

-

- No. Since this decision was made by FEMA and not TWC, claimants cannot appeal.

-

Do I need to re-apply for TWC benefits if furloughed again?

- If it has been three weeks or less since your last payment request:

- Request payment through the TWC portal or call 1-800-558-8321.

- Be sure to report any hours you worked and any earnings during the period requested.

- If it has been more than three weeks since your last payment request:

- Apply for Benefits again at ui.texasworkforce.org or by calling our Tele-Center at 800-939-6631.

- To help TWC activate your claim quickly, select layoff as the reason you lost your job if you were furloughed or the business closed.

What happens if my regular unemployment benefits are exhausted?

After exhausting regular unemployment benefits, Extended Benefits are available to workers for an additional 50% of their maximum benefit amount until 10/18/20. If the employee recently exhausted their regular unemployment benefits, they should continue to submit their payment request through their TWC account. This will trigger TWC to add the additional extended benefits.

Employee Benefits

Health Insurance

While an employee is furloughed there is no interruption in benefits. For example, furloughed employees’ medical insurance will continue as usual. Employees will still owe their portion of the premiums.

401k Options

The CARES Act would allow participants to take penalty-free withdrawals for those who meet certain criteria related to the coronavirus (COVID-19)

- Employees can make withdrawals from their 401k up to $100,000

- There will be no penalty, and if you repay it in less than 3 years no tax is due.

- If you don’t put it back in, you have 3 years to pay the tax due

FMLA Options

Eligible employees may qualify to receive compensation for up to 12 weeks under the “Emergency Family and Medical Leave Expansion Act”. FMLA has been temporarily expanded to include coverage for employees that no longer have childcare due to COVID-19. Eligible employees must be active after 04/01/20.

Contact Human Resources if you would like to claim FMLA, or request a determination on your eligibility under the new law. Read more about the “Emergency Family and Medical Leave Expansion Act” and the “Emergency Paid Sick Leave Act” under Government legislation.

Am I eligible to use paid time off if I am furloughed?

No. Employees can not use paid time off in lieu of being furloughed.

Do I still accrue vacation hours while I am furloughed?

Yes!

Educational Reimbursement

At this time, this benefit has been temporarily suspend.

Fitness & Cell Phone Reimbursement

At this time, ASI is still offering this benefit. We are in the process of reviewing all essential expenses and will take action to temporarily suspend benefits if necessary.

Government Legislation

Where do I find official legislation documents from Congress?

You can review any legislation at www.congress.gov. Review the quick links below for legislation referred to in this document.

- Families First Coronavirus Response Act

- DIVISION C: Emergency Family and Medical Leave Expansion Act

- DIVISION E: Emergency Paid Sick Leave Act

- CARES Act

What is the “Emergency Paid Sick Leave Act”?

Congress passed legislation in the Families First Coronavirus Response Act that mandates employers provide employees with paid sick leave in the event he/she is unable to work (or telework) due to COVID-19. Employees must be active as of April 1.

Am I eligible for “Emergency Paid Sick Leave Act”?

Eligible employees must be active after April 1, 2020 and meet one of the following qualifying needs.

- To self-isolate because of a diagnosis of COVID-19, or to comply with a recommendation or order to quarantine due to exposure or exhibition of symptoms;

- To obtain a medical diagnosis or care if the employee is experiencing symptoms of the coronavirus;

- To care for a family member who is self-isolating due to a diagnosis of coronavirus, experiencing symptoms of coronavirus and needs to obtain medical diagnosis or care, or quarantining due to exposure or exhibition of symptoms; or

- To care for a child whose school has closed, or childcare provider is unavailable, due to the coronavirus. See standards for eligible childcare providers.

Compensation for the “Emergency Paid Sick Leave Act”

ASI will compensate employees at their regular rate for any paid sick time they take up-to 80 hours in the event they’re quarantined due to COVID-19, advised by a health care provider to self-quarantine, or an employee is experiencing symptoms of COVID-19. If an employee is using emergency paid sick leave to care for a family member or child, the employee is only entitled to two-thirds of their regular rate of pay unless otherwise agreed upon.

What is the “Emergency Family and Medical Leave Expansion Act”?

Congress passed legislation on March 18, 2020 that expanded FMLA to include eligible employees impacted by COVID-19.

Am I eligible for the “Emergency Family and Medical Leave Expansion Act”?

Eligible employees must be active after April 1, 2020 and meet one of the following qualifying needs.

- To adhere to a requirement or recommendation to quarantine due to exposure to or symptoms of coronavirus

- To care for a family member who is adhering to a requirement or recommendation to quarantine due to exposure to or symptoms of coronavirus; and

- To care for a child due to a school or place of care has been closed, or the childcare provider is unavailable, due to the coronavirus. See standards for eligible childcare providers.

Compensation for the “Emergency Family and Medical Leave Expansion Act”

The first 10 work days are unpaid, however, employees can elect to use the Emergency Paid Sick Leave Act during this period. After the initial 10 work days, employees will be paid two-thirds of the employee’s usual rate of pay for up to 10 weeks unless otherwise agreed upon.

When do these new laws go into effect?

Financial Assistance Programs by County

Dallas County

- Emergency Housing Assistance – Does not include the City of Dallas

- Financial Assistance – City of Dallas

- Rental Assistance Program – Does not include the City of Fort Worth

- Emergency Household Assistance Program – Specific to the City of Fort Worth

- Harris County – Program has been turned offline — Option to call about other financial resources